Welcome to the whimsical world of credit scores, where numbers dance and financial futures are forged! Think of your credit score as the magical passport to the land of loans, where a mere digit can determine if you bask in the glow of approval or face the dismal dungeon of rejection.

Your credit score isn’t just a number; it’s a reflection of your financial habits, a blend of payment history, credit utilization, and even the types of credit you wield. Maintaining a good credit score isn’t merely a suggestion; it’s a treasure map leading to better interest rates and the golden opportunities of financial products. So grab your compass, and let’s navigate this credit conundrum together!

Credit Score Fundamentals

A credit score is like your financial report card, except you can’t just blame your teachers for giving you a C. Instead, it reflects how well you manage your money, and it can make or break your financial dreams. Whether you’re looking to buy a house, a car, or maybe even that shiny new gaming console, understanding credit scores is crucial to your financial health.

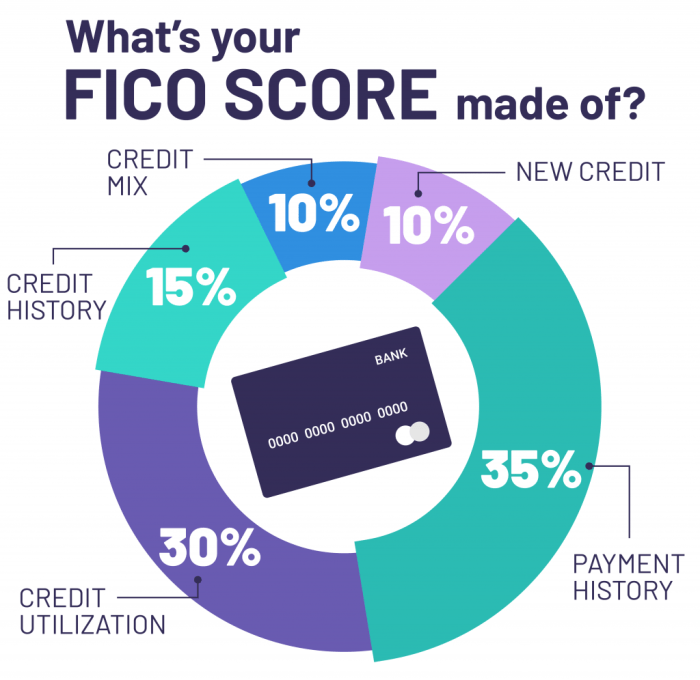

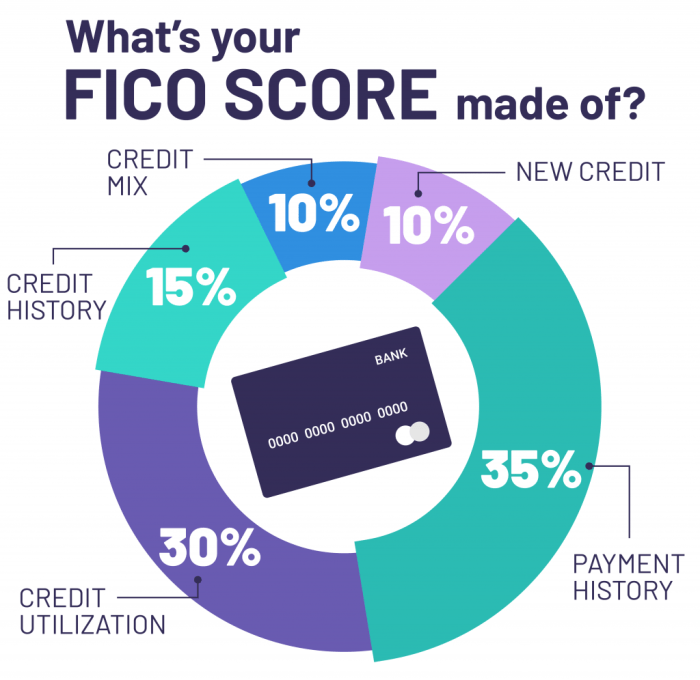

Let’s dive into the nitty-gritty of credit scores, shall we?Credit scores range from 300 to 850, with higher scores indicating better creditworthiness. Several key components contribute to your score, and neglecting any of them could lead to a nosedive. The main factors include payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Each plays a unique role, almost like a superhero team, but instead of fighting evil, they’re fighting against poor credit decisions.

Components of a Credit Score

Understanding what drives your credit score can be as enlightening as finding out that your favorite snack is actually healthy (spoiler: it’s not). Here’s what makes up the magic formula:

- Payment History (35%) – This is like the bread and butter of your credit score. It tracks whether you pay your bills on time. Missed payments? They can stay on your record for up to seven years, like an unwelcome house guest.

- Credit Utilization (30%) – This tells lenders how much of your available credit you’re actually using. Aim to keep this below 30% to avoid raising any red flags. Think of it as not maxing out your credit card while buying giant inflatable flamingos for your backyard.

- Length of Credit History (15%) – The longer you’ve had credit, the more trustworthy you appear to lenders. Old credit accounts are like fine wine; they get better with age, but only if you manage them well.

- Types of Credit Used (10%) – Diversity is key! A mix of credit cards, mortgages, and installment loans shows you can handle different types of debt. Just like how a good diet includes a variety of food groups, but not too many cupcakes (we wish!).

- New Credit Inquiries (10%) – Each time you apply for a new credit line, a hard inquiry is made. Too many of these can suggest you’re a desperate shopper, leading to a dip in your score. So, think before you leap into the world of credit card applications!

Importance of Maintaining a Good Credit Score

Maintaining a good credit score is as essential as regularly changing your car’s oil; neglect it, and you might just break down when you need to cruise into a new home or car loan. A solid credit score can save you loads in interest rates, and in some cases, it could be the difference between getting a loan or being turned away at the door of your dreams.Consider this: a borrower with a credit score of 760 can often snag a mortgage rate that’s nearly a full percentage point lower than someone with a score of 620.

This might sound trivial, but over a 30-year mortgage, that could mean saving tens of thousands of dollars! Now that’s something to smile about, unless you’re smiling while holding a bad credit score—then it’s just awkward.In summary, knowing the ins and outs of your credit score and its components is vital for achieving financial success, and it can turn the daunting world of finance into a more manageable and even humorous adventure.

Just remember to treat your credit score like the precious gem it is, and it will reward you handsomely when it counts!

Improving Your Credit Score

Improving your credit score isn’t just about being a responsible adult; it’s like giving your financial self a superhero cape! Picture this: your credit score is the shining emblem that grants you entry into the world of low-interest rates and fabulously approved loans. But how do you elevate this numerical sidekick from zero to hero? Let’s dive into some rather effective, and possibly humorous, strategies!Timely payments and smart debt management are the bread and butter of credit score improvement.

It’s like feeding your credit score a balanced diet; it thrives on healthy, consistent payments. Late payments? Those are the junk food of credit scores – they may taste good for a second, but they leave a nasty aftertaste and a long-lasting impact. Let’s explore the delightful world of credit tips that can help your score rise faster than a cat meme goes viral!

Effective Strategies for Improving a Low Credit Score

Let’s get you on the path to credit greatness! Here are some key strategies that can assist in your quest to improve your credit score:

- Pay Your Bills on Time: Settle those bills like you settle a score with your high school rival. Timely payments make up about 35% of your credit score. So, if you want your score to shine like a diamond, be punctual!

- Reduce Your Debt: Try to keep your credit utilization ratio below 30%. If you owe $1,000 on your credit cards and your limit is $5,000, you’re golden! If not, it’s time to do some financial spring cleaning.

- Keep Old Accounts Open: Your credit history length accounts for around 15% of your score, so don’t close those old accounts just because they remind you of a less-than-stellar shopping spree.

- Limit New Credit Inquiries: Each time you apply for credit, it’s like a small paper cut to your score. Be selective and strategic about when you apply for new credit.

- Mix Your Credit Types: A diverse mix of credit can improve your score. Think of it as a well-balanced diet: a little bit of credit card here, a sprinkle of a car loan there, and maybe a mortgage for good measure!

Implementing these strategies can transform your credit score into a veritable success story. Remember, Rome wasn’t built in a day, and neither is a stellar credit score. The more diligent you are, the more likely your financial future will glow like a well-lit runway.

Financial Products and Credit Score Impact

When it comes to your credit score, various financial products hold the power to either lift you up or throw you into a financial black hole. Understanding how these products influence your credit score is vital for making informed decisions that benefit your financial health. From home equity loans to lease agreements, let’s dive into the delightful world of credit score impacts and how different products can change the game.

Home Equity Loans and Debt Consolidation

Home equity loans and debt consolidation are two financial products that can significantly impact your credit score, but they do so in different ways. Think of a home equity loan as the friendly neighbor who lends you their lawnmower, while debt consolidation is that wise friend who helps you gather your many debts into one manageable flowerpot.Both can lower your credit utilization ratio, but here’s how they differ:

- Home Equity Loans: Tapping into your home’s equity can give your credit score a boost if you use the funds wisely. However, taking out a loan also adds a new debt to your profile, temporarily lowering your score. It’s a bit like adding a new pair of shoes; they might be fabulous, but they can also pinch if you’re not careful.

- Debt Consolidation: By consolidating multiple debts into one loan, you can simplify payments and potentially secure a lower interest rate. This move can improve your score in the long run, as long as you don’t rack up new debt while trying to pay off the old. Remember, it’s like cleaning your closet; make sure you don’t just stuff it full again!

Both products can be beneficial, but only if used thoughtfully, ensuring you don’t dive into a deeper pit of debt.

Influence of Credit Counseling on Credit Scores

Credit counseling services offer guidance and strategies for managing debts effectively, which can have a profound impact on your credit score. Imagine a life coach, but instead of building muscles, you’re building a stronger financial future.Credit counseling can lead to improved credit scores through:

- Budgeting Assistance: Counselors help you create a budget, allowing you to allocate funds towards timely bill payments, thus positively affecting your credit score.

- Debt Management Plans (DMP): Enrolling in a DMP can lower your monthly payments, making it easier to stay on track. Think of it like a workout plan; you’re less likely to skip leg day when it’s scheduled with a buddy!

- Education and Resources: Learning about credit scores and how they work can empower you to make smarter financial decisions. Knowledge is power, and in this case, it’s also a credit score booster.

Credit counseling can be the GPS navigation system for your financial journey, guiding you away from debt detours!

Relationship Between Leases and Credit Scores

Leases can also affect your credit score, but the relationship can be a bit complicated—like trying to understand why your cat prefers a box over a cozy bed. Lease payments are typically reported to credit bureaus, and this can influence your score based on your payment history.Key points about leases include:

- Payment History: Just like mortgages, timely lease payments can enhance your credit score. Late payments, however, can be the unwelcome addition that drags your score down like an anchor in a swimming pool.

- Credit Reporting: Some leasing companies report to credit bureaus, while others do not. If your lease isn’t reported, you might miss out on the chance to boost your score with those on-time payments. It’s like having a running record of your treadmill sessions, but forgetting to hit ‘save’!

- Types of Leases: Different lease structures may affect your credit differently. For instance, a lease-to-own agreement can have a more favorable impact than a standard rental agreement, as it may contribute to the perception of you as a responsible borrower.

Understanding how your lease payments are reported can help you make strategic decisions that benefit your credit score over time.

Ending Remarks

In conclusion, the saga of the credit score is one of highs and lows, twists and turns, but fear not! With the right strategies, timely payments, and a sprinkle of financial wisdom, you too can transform your credit score from a timid mouse to a roaring lion. So go forth, conquer those debts, and let your credit score shine as the beacon of your financial prowess!

FAQ Explained

What is a credit score?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850, indicating how likely you are to repay borrowed money.

How often should I check my credit score?

It’s wise to check your credit score at least once a year to monitor your financial health and catch any errors early.

Can I improve my credit score quickly?

While significant improvements take time, you can boost your score relatively quickly by paying down debts and ensuring all payments are made on time.

Do hard inquiries affect my credit score?

Yes, hard inquiries can temporarily lower your credit score, so it’s best to limit them when looking for new credit.

How long does it take to rebuild a credit score?

Rebuilding a credit score can take anywhere from a few months to several years, depending on your financial behavior and the severity of past issues.