Welcome to the thrilling world of Home equity loan rates, where your dreams of financial freedom might just be lurking in your living room! Think of it as a treasure hunt, where the treasure is buried in the equity of your home, just waiting for you to dig it up with some savvy borrowing. Whether you’re looking to renovate your castle, consolidate debt, or just treat yourself to that shiny new gadget, understanding these rates is your golden key!

Home equity loan rates are determined by a delightful cocktail of factors, including your credit score and the ever-changing market conditions. With fixed and variable options dancing around like eager contestants on a reality show, choosing the right one can feel like picking a favorite flavor of ice cream—it’s all about what tickles your fancy!

Home Equity Loan Rates Overview

Home equity loan rates are the financial equivalent of a high-stakes poker game where your house is the ante. This thrilling game of interest rates hinges on how much equity you’ve built in your home and the performance of the economy. The better your cards—oops, we mean your financial profile—the better the rates you can snag. Let’s dive in and decipher the mystery behind those elusive numbers.Home equity loan rates represent the cost of borrowing against the equity you’ve built in your home.

These rates are determined by a variety of factors, including your credit score, the amount of equity you have, and broader market conditions. Think of your credit score as your golden ticket—higher scores often lead to lower rates. Conversely, if your score resembles an overly ripe banana, prepare for some higher interest rates. Market conditions, including the Federal Reserve’s interest rates and overall inflation, can also significantly impact what lenders offer.

Factors Affecting Home Equity Loan Rates

Several key factors influence the rates you receive when applying for a home equity loan. Understanding these can help you better prepare for your financial adventure.

- Credit Score: Your credit score is like a scorecard at an amusement park—better scores mean better rides (or rates)! A score of 740 or above typically qualifies you for the best rates, while scores below that might lead to higher costs.

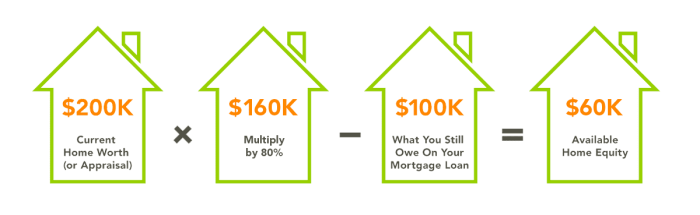

- Loan-to-Value Ratio (LTV): This ratio tells lenders how much of your home’s value you’re looking to borrow. A lower LTV ratio indicates less risk for lenders and can lead to more favorable rates.

- Market Conditions: The economic climate is an ever-changing beast. When interest rates rise, you might find yourself paying more for that home equity loan. Conversely, a dip in rates could offer a golden opportunity for lower borrowing costs.

- Type of Loan: The type of home equity loan you choose—fixed or variable—can influence the rate. Fixed rates provide stability, while variable rates can fluctuate over time, potentially leading to cost savings or surprises.

Fixed vs. Variable Home Equity Loan Rates

Choosing between fixed and variable rates is akin to choosing between a cozy sweater and a breezy tank top—both have their pros and cons, depending on the season (or market conditions)!With a fixed-rate home equity loan, you lock in your interest rate for the life of the loan. This means your monthly payments remain steady, regardless of market fluctuations. It’s like having a loyal pet that never changes—comforting and predictable.On the flip side, variable-rate loans often start with lower initial rates, which can feel like a fun rollercoaster ride.

However, as the market shifts, so does your interest rate—meaning your payments could skyrocket, or you might enjoy a delightful dip in costs. Here’s a quick comparison to illustrate:

| Aspect | Fixed Rate | Variable Rate |

|---|---|---|

| Stability | Consistent and predictable | Can fluctuate |

| Initial Rate | Higher | Typically lower |

| Long-term Costs | Known upfront | Can vary significantly |

| Best for | Budgeting | Short-term savings |

In conclusion, understanding home equity loan rates and their determinants can position you wisely in the financial realm, maximizing your borrowing potential while managing risks and rewards effectively.

Comparison of Home Equity Loan Rates

When it comes to home equity loans, comparing rates is like shopping for a new car—except instead of test-driving, you just stare at numbers and pray they’re good. Home equity loan rates can vary dramatically depending on the lender, and a little diligence can save you a heap of cash. Let’s take a comedic yet educational dive into the current rates and how you can find the best offers without losing your sanity.

Current Home Equity Loan Rates from Various Lenders

As of the latest data, home equity loan rates can range from around 3.5% to over 7%, depending on whether your lender is feeling generous or just downright grumpy. Here’s a quick comparison of rates from a few popular lenders:

| Lender | Rate (%) | Terms (Years) |

|---|---|---|

| Bank A | 3.75 | 10 |

| Bank B | 4.10 | 15 |

| Credit Union C | 3.60 | 10 |

| Bank D | 6.00 | 20 |

With rates fluctuating like a caffeinated squirrel, it’s crucial to gather as much intel as possible before signing on the dotted line.

Methods for Finding the Best Home Equity Loan Rates

Finding the best home equity loan rates is akin to hunting for treasure—except the treasure comes in the form of lower monthly payments and less stress. Here are several methods to navigate through the rate jungle:

- Utilize Online Comparison Tools: Websites like Bankrate or NerdWallet can be your trusty map, leading you through the maze of lenders and their offerings.

- Consult with Mortgage Brokers: These professionals have insider knowledge and can guide you to lenders you might not find on your own.

- Check Directly with Lenders: Sometimes, going straight to the source can yield special rates or discounts that are not publicly advertised.

- Consider Local Credit Unions: Often, credit unions offer competitive rates for their members, so it pays to investigate if you’re eligible for membership.

Benefits of Shopping Around for Home Equity Loan Rates

Shopping around for home equity loan rates isn’t just a good idea; it’s practically a financial necessity! Think of it as trying on shoes before buying—who wants to walk away with a pair that pinches? Here are the key benefits of exploring various options:

- Better Rates: Different lenders offer different rates, and finding the lowest one can save you thousands over the life of your loan.

- Variety of Terms: By comparing, you can find terms that suit your financial situation, whether you want a shorter loan term or a lower monthly payment.

- Negotiation Power: When you have multiple offers, you can leverage them to negotiate better terms with your preferred lender.

- Peace of Mind: Knowing you’ve explored all options lets you rest easy, knowing you made the best financial decision.

Financial Strategies Involving Home Equity Loans

Home equity loans can be a financial wizard’s best friend, offering magical solutions to some of your most perplexing money challenges. One of the most enchanting uses of these loans is for debt consolidation, but let’s not stop there! We’ll also explore how credit counseling can add a dash of sanity to managing these loans, and how to sprinkle a little estate planning magic with home equity in the mix.

Debt Consolidation Benefits

Using a home equity loan for debt consolidation is like taking a broomstick to your financial clutter. You can pay off high-interest debts, such as credit cards, with a lower interest home equity loan. Meanwhile, you’ll be sipping tea while watching those pesky debts vanish into thin air! This can significantly improve your overall finances by reducing monthly payments and freeing up cash for other (less mystical) expenses.When you consolidate debt using a home equity loan, you essentially transform multiple payments into a single monthly payment.

Imagine the comfort of not having to juggle a circus of bills. Here’s how it impacts your finances:

- Lower interest rates can save you substantial money over time.

- Streamlined payments mean less stress and fewer missed deadlines.

- Potentially improved credit score by reducing overall credit utilization.

“Debt consolidation is not just about combining loans; it’s about creating a new financial reality.”

Role of Credit Counseling

Credit counseling is the wise old sage of the financial world, guiding you through the labyrinthine paths of debt management. This service can help you devise a plan that leverages your home equity loan effectively while also ensuring you don’t end up in a financial Bermuda Triangle.By working with a credit counselor, you can gain insights into your financial situation and receive tailored advice on how to handle your home equity loan.

Here are some key points to consider when utilizing credit counseling:

- Personalized guidance on how to use your home equity wisely.

- Strategies to maintain a healthy credit score while managing loans.

- Access to resources for budgeting and financial planning.

“Credit counseling is like having a financial GPS, ensuring you don’t take a wrong turn on your road to recovery.”

Leveraging Home Equity in Estate Planning

Home equity loans can also play a vital role in your estate planning, like a trusty steed in a knight’s quest. They can provide liquidity for your estate, making it easier to manage taxes and other expenses upon your passing. However, it’s essential to understand the potential risks before galloping off into these financial strategies.Using home equity in your estate plan can help preserve your legacy for your heirs.

However, careful planning is crucial to avoid unexpected pitfalls. Here are some vital considerations to keep in mind:

- Ensure you fully understand the loan terms and how they impact your estate.

- Consider potential impacts on your heirs, including responsibilities for repayment.

- Consult with a financial advisor to ensure your estate is protected and your wishes are honored.

“A well-crafted estate plan is like a treasure map, guiding your heirs to their rightful inheritance without losing their way.”

Epilogue

In summary, navigating the maze of Home equity loan rates doesn’t have to be a daunting task! With a bit of knowledge and a sense of adventure, you can unlock the potential of your home equity and make informed decisions that will serve you well in your financial journey. So grab your compass and set sail—your financial treasure awaits!

Question & Answer Hub

What is a home equity loan rate?

A home equity loan rate is the interest rate charged on a loan secured by the equity in your home, which can be used for various purposes such as renovations or debt consolidation.

How can I improve my home equity loan rate?

You can improve your home equity loan rate by boosting your credit score, reducing your debt-to-income ratio, and shopping around for the best offers.

Are home equity loan rates fixed or variable?

Home equity loans typically come in two flavors: fixed rates, which remain the same throughout the life of the loan, and variable rates, which can fluctuate based on market conditions.

How does my credit score affect my home equity loan rate?

Generally, a higher credit score can lead to lower home equity loan rates, as lenders see you as a lower-risk borrower. It’s like showing up to a party with a great outfit—you’ll likely get more attention!

Can I use a home equity loan for anything?

Yes, you can use a home equity loan for a variety of purposes, from home improvements to debt consolidation, but remember, with great power comes great responsibility!