Consolidate debt, a magical phrase that can turn your financial frowns upside down! Imagine a world where your debts are not multiple monsters lurking under your bed but a single, manageable pet—perhaps a goldfish. Debt consolidation is the process of combining various debts into one, simplifying your life and potentially lowering your monthly payments. What’s not to love about that?

In this thrilling saga, we’ll explore the many methods of debt consolidation, the pros and cons of each, and even sprinkle in some finance tips that could turn you into a debt-management superhero. We’ll demystify credit counseling, reveal the potential of home equity loans, and even toss in some estate planning magic for good measure. So, grab your financial cape and let’s soar!

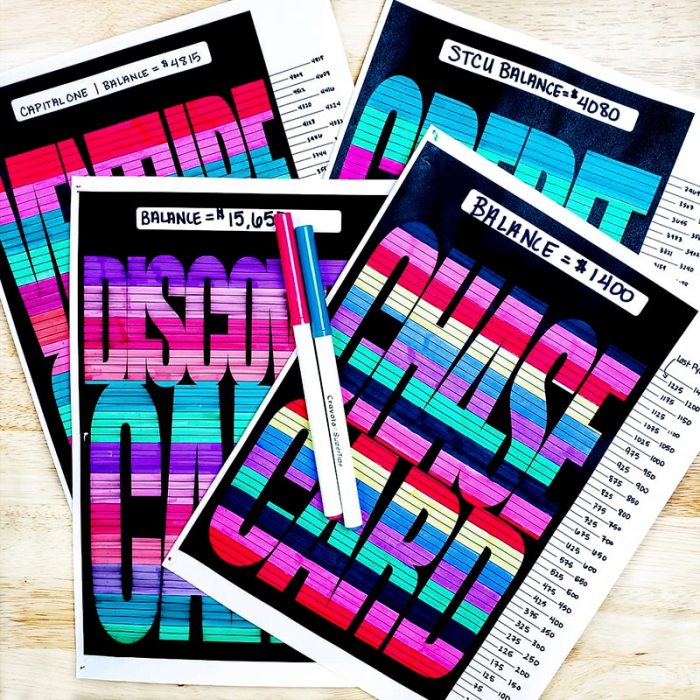

Debt Consolidation Overview

Debt consolidation might sound like a fancy term that only financial wizards understand, but it’s really just a clever strategy to manage your debts. Imagine taking a chaotic pile of bills and condensing them into one manageable monthly payment. It’s like turning a wild, tangled ball of yarn into a neat little ball that won’t trip you up every time you walk by! With debt consolidation, you can enjoy benefits like lower interest rates, simplified payments, and possibly even a boost to your credit score.

When it comes to consolidating debt, there are several methods available, each with its own flair and potential for turning your financial frown upside down. Here’s a breakdown of the popular approaches:

Methods of Debt Consolidation

Whether you’re a wizard with numbers or someone who gets a headache just thinking about finance, understanding these methods can help you find the right fit for your situation.

- Personal Loans: One of the most common methods is taking out a personal loan to pay off all your existing debts. Think of it as getting a superhero to swoop in and save your finances!

- Balance Transfer Credit Cards: These cards offer a low or 0% introductory interest rate on transferred balances. It’s like getting a golden ticket to a debt-free wonderland, if you can pay it off before the rates skyrocket!

- Home Equity Loans: For homeowners, tapping into home equity can be a smart move. Use your home’s value to take out a loan, but beware: your house is collateral, so handle with care!

- Debt Management Plans (DMPs): These programs involve working with a credit counseling agency to negotiate lower payments with your creditors. It’s like having a financial coach cheering you on as you tackle your debt hurdles.

While debt consolidation can feel like a lifeline, it’s also essential to consider the potential drawbacks that might come along for the ride.

Potential Drawbacks of Debt Consolidation

Just like every superhero has a weakness, debt consolidation has its own set of challenges that could trip you up if you’re not careful. Understanding these pitfalls can keep you one step ahead.

- Fees and Costs: Some methods, like balance transfer cards and personal loans, may come with fees. It’s crucial to read the fine print; hidden fees can sneak up on you faster than a cat on a laser dot!

- Longer Repayment Terms: While lower monthly payments might be appealing, extending the repayment timeline can result in paying more interest over time. It’s the tortoise-and-hare race, where sometimes the slow and steady can get you in trouble.

- Not Addressing Underlying Issues: Consolidating debt doesn’t solve the root problem of spending habits. Without addressing these issues, you might find yourself trapped in the same cycle again, like a hamster on a wheel.

- Potential Impact on Credit Score: Depending on the method used, your credit score could take a hit. For example, applying for new credit cards might result in a hard inquiry, which may lower your score temporarily. It’s like a small bump on the road to recovery!

“Debt consolidation can be a powerful tool in your financial toolbox, but understanding its nuances is key to wielding it wisely!”

Financial Strategies for Debt Management

Navigating the winding roads of debt can feel like trying to find your way out of a corn maze while wearing a blindfold. Fear not! With the right financial strategies, managing consolidated debt can transform from a daunting task into a manageable journey, complete with signposts and maybe even a few laughs along the way. Let’s dive into the strategies that can pave the path toward financial freedom.

Finance Credit Tips for Managing Consolidated Debt

Managing consolidated debt is like herding cats—challenging but not impossible! By implementing effective finance credit tips, individuals can regain control of their financial lives. Here are some tips that can help keep your debt in check while also providing a chuckle or two:

- Create a Budget: A well-planned budget is like a map for your finances. It shows you where to go and helps you avoid dead ends. Track your income and expenses to see where your money goes, and make adjustments to keep your spending in line with your goals.

- Prioritize Payments: Just like a game of poker, sometimes you need to know which cards to play first. Focus on paying off high-interest debts first. This strategy minimizes interest payments and can save you money in the long run.

- Stay Consistent: Regular payments are key to success. Make it a habit to pay more than the minimum whenever possible. Treat it like your morning coffee—essential and never skipped!

- Emergency Fund: Think of your emergency fund as your financial superhero. It swoops in when unexpected expenses arise, preventing you from adding more debt. Saving just a little each month can build a solid safety net.

Credit Counseling Assistance in Debt Consolidation

Credit counseling can be the guiding light in your personal finance tunnel, illuminating the path towards effective debt management. It’s like having a wise wizard by your side, guiding you to financial enlightenment. Credit counselors provide personalized advice and resources that can help individuals make informed decisions about their debts.A professional counselor can analyze your financial situation, create a budget, and develop a debt repayment plan tailored specifically for you.

They can also negotiate with creditors on your behalf, aiming to secure lower interest rates or settlements that could ease your burden significantly. Additionally, credit counseling agencies often offer workshops and educational resources, arming you with knowledge to fend off future debt dragons.

Comparison of Debt Relief Options

When it comes to debt relief options, it’s essential to know what’s on the menu before making a choice. Each option has its unique flavor and can appease different financial cravings. Here’s a detailed comparison table of various debt relief options:

| Debt Relief Option | Description | Pros | Cons |

|---|---|---|---|

| Debt Consolidation Loan | A single loan that combines multiple debts into one. | Simplified payments, potentially lower interest rates. | May require good credit, could lead to more debt if not managed well. |

| Credit Counseling | Advisory services to help manage debt and create a budget. | Personalized advice, negotiation with creditors. | Fees may apply, success depends on commitment. |

| Debt Settlement | Negotiating with creditors to pay less than owed. | Can significantly reduce total debt owed. | May harm credit score, potential tax implications. |

| Bankruptcy | A legal process to eliminate or restructure debts. | Provides a fresh start, legal protection from creditors. | Can severely impact credit score, long-lasting effects. |

In the world of debt management, choosing the right strategy is crucial. Understanding the options available can help individuals make informed decisions, leading to improved financial health and, ultimately, a life free of the shackles of excessive debt. A bit of planning, a sprinkle of humor, and a dash of persistence can turn a financial mess into a success story.

Additional Financial Tools and Considerations

When it comes to consolidating debt, it’s not just about shuffling numbers around like a magician with a deck of cards. There are a plethora of financial tools and considerations that can help you manage your debt more effectively. From home equity loans to estate planning, every financial strategy deserves its moment in the spotlight.

Role of Home Equity Loans in Debt Consolidation Strategies

Home equity loans can be the secret weapon in your debt consolidation toolkit, turning your house into a financial superhero. By borrowing against the equity you’ve built in your home, you can fund debt consolidation at potentially lower interest rates than your existing debts. This means you can pay off high-interest credit cards and loans while keeping your monthly payments manageable.Consider this: if your home is worth $300,000 and you owe $200,000, you might be sitting on $100,000 in equity.

A home equity loan of $50,000 could allow you to consolidate various debts while leaving you with an extra cushion for emergencies – or a last-minute trip to a tropical paradise (just kidding, sort of). However, remember that your home is on the line, and failing to repay could have you trading your beach towel for a foreclosure sign.

Implications of Leases and Leasing Options in Debt Management

Leasing is not just for fancy cars or that snazzy apartment with the view; it can also play a significant role in your overall financial health. When you lease, you’re basically renting an asset for a fixed period. Although leasing can conserve cash flow, it may not be the best option for debt management.While leasing may provide lower monthly payments compared to purchasing outright, it can lead to a cycle of perpetual payments.

Instead of owning an asset, you might find yourself in a never-ending loop of payments, like the treadmill you bought with that credit card debt. Here’s a quick rundown of some considerations when weighing leases:

- Cash Flow Management: Leasing can help maintain liquidity by keeping your cash flow intact, allowing you to prioritize paying down higher-interest debts.

- Asset Ownership: At the end of the lease term, you typically don’t own the asset, which means you may need to lease again or buy a new one, leading to ongoing costs.

- Tax Implications: Depending on your situation, leasing may offer tax benefits, especially for business-related assets. Check with a tax professional to navigate the fine print.

Creating an Estate Plan Trust for Financial Stability and Debt Relief

An estate plan trust is like having a personal financial bodyguard; it protects your assets and ensures they are distributed according to your wishes upon your departure from this mortal realm (and helps with debt relief while you’re still around!). Establishing a trust can not only save your family the headache of probate but also provide a solid strategy for managing debts and assets.A trust allows your assets to bypass probate, which can be a costly and time-consuming process, especially if creditors are knocking at the door.

Having a trust means that your beneficiaries can receive their inheritance without the burden of your outstanding debts, ideally leaving them the financial freedom to live their lives (or at least not inherit your student loans). Here are some key benefits:

- Asset Protection: Assets held in a trust can be shielded from creditors, meaning your beneficiaries receive the full benefit of your hard-earned money.

- Tax Benefits: Depending on the structure of the trust, there could be potential tax advantages that can help with overall financial stability.

- Control Over Distribution: You can dictate when and how your assets are distributed, providing peace of mind that your loved ones will be financially secure.

“A good estate plan is like a well-timed punchline; it delivers your wishes and keeps the drama to a minimum.”

Final Summary

As we wrap up this adventure through the world of debt consolidation, remember that every financial journey has its ups and downs. With the right strategies and a sprinkle of courage, you can take control of your debts and pave the way to a brighter financial future. So go forth, consolidate those debts, and transform your life from financially frazzled to fabulously free!

Key Questions Answered

What is debt consolidation?

Debt consolidation is the process of combining multiple debts into one single debt, usually with a lower interest rate.

How can debt consolidation help me?

It can simplify your payments, potentially lower your interest rates, and improve your cash flow.

Are there any risks to debt consolidation?

Yes, if not managed properly, it can lead to more debt or a longer repayment period.

Can I consolidate student loans?

Yes, federal and private student loans can often be consolidated, but make sure to research your options!

What is a home equity loan?

A home equity loan allows you to borrow against the equity in your home, which can be used for debt consolidation.