Improve credit score, and you’re on the path to financial glory! Think of your credit score as your financial superhero cape—without it, you might be left feeling a bit like Clark Kent at a costume party. This guide will take you through the thrilling world of credit scores, revealing what they are, how they’re calculated, and why they matter more than finding that last slice of pizza at a party.

From understanding the nitty-gritty components that make up your magical three-digit number to discovering actionable strategies that can launch your score into the stratosphere, we’ve got you covered. Whether you’re a credit rookie or a seasoned pro looking to polish that score, get ready for a ride filled with tips, tricks, and a sprinkle of humor to keep you entertained along the way!

Understand Credit Scores

To navigate the wild world of personal finance, understanding credit scores should be your trusty compass. They’re not just three-digit numbers; they’re the magical keys to unlock a kingdom filled with loans, mortgages, and better interest rates. But before you start dreaming about your new castle, let’s break down what a credit score really is and why it matters.Credit scores are determined by a variety of components, each playing a critical role in your financial narrative.

The most influential factors include your payment history, amounts owed, length of credit history, new credit inquiries, and types of credit used. Each of these components contributes differently to your score, like ingredients in a secret sauce recipe that the credit gods have kept under wraps.

Components of a Credit Score

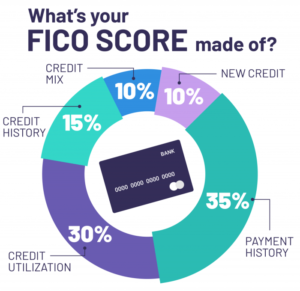

Understanding the breakdown of your credit score is essential for achieving financial mastery. Here’s how the score is typically calculated, using the FICO model as an example:

- Payment History (35%): This is the big daddy of credit score components. It tracks whether you’ve made payments on time and how often you’ve missed them. Late payments are like the bad ex-partner who keeps showing up at parties—definitely not good for your reputation!

- Amounts Owed (30%): Also known as credit utilization, this shows how much credit you’re using compared to your total available credit. Aim to keep this ratio below 30%. Think of it as keeping your plate at a buffet just the right size—too piled up and it’s a mess!

- Length of Credit History (15%): This factor looks at how long your credit accounts have been active. Long-time accounts are like old friends; they bring stability and wisdom to your financial journey.

- New Credit (10%): Every time you apply for a new line of credit, it can temporarily ding your score. It’s like taking a group photo and realizing your hair is a complete disaster. Just avoid too many applications in a short time!

- Types of Credit Used (10%): A mix of credit accounts—such as credit cards, mortgages, and installment loans—can show lenders you’re a responsible borrower. It’s like having varied interests; it keeps life exciting!

“Your credit score is like a report card for adults—except there’s no summer vacation.”

Importance of a Good Credit Score

A healthy credit score is vital to your overall financial health and affects numerous aspects of your life. From loan approvals to interest rates, having a good credit score can save you a significant amount of money over time. For instance, a higher credit score often leads to lower interest rates on mortgages and car loans, translating to lower monthly payments.

Imagine you’re shopping for a car. With a good credit score, you might snag a loan at 3% interest, while your friend with a so-so score ends up with a 7% interest rate. Over five years, that seemingly small difference can amount to thousands of dollars in extra payments. It’s the difference between a budget-friendly sedan and an all-you-can-eat ramen lifestyle!Additionally, landlords and employers often check credit scores as part of their application processes, making it a critical aspect of your financial footprint.

It can even play a role in securing insurance deals. In essence, a good credit score gives you options, opportunities, and the chance to strut your financial stuff like a peacock on a catwalk.

Strategies to Improve Credit Score

Improving your credit score is like trying to lose those pesky last five pounds; it takes time, patience, and a little bit of strategy. Luckily, with the right moves, you can buff up that score until it shines like a trophy in a beauty pageant. Here’s how you can flex those financial muscles and make your credit score the envy of all your friends.

Importance of On-Time Payments

Making on-time payments is the heavyweight champion of credit score improvement. Why? Because payment history accounts for a whopping 35% of your credit score. It’s like the bread and butter of your financial diet—skip it, and you’ll be feeling the consequences.

“On-time payments are to your credit score what spinach is to Popeye—essential for strength!”

To ensure you’re never late on payments, consider these strategies:

- Automate Your Payments: Set up automatic payments for your bills. It’s like having a personal assistant reminding you to pay, without the extra salary.

- Use Calendar Reminders: If automation feels too robotic, mark your calendar. Treat it like a hot date—because paying your bills is a relationship you want to nurture.

- Pay More Than the Minimum: Paying only the minimum is like eating just one potato chip—you know it’s not enough. Aim to pay off your balance in full whenever possible.

Reducing Credit Utilization Ratio

Your credit utilization ratio is another heavyweight contender, representing 30% of your total credit score. Think of it as your credit card diet—if you’re going overboard, it’s time to trim the excess.

“A lower credit utilization ratio is your ticket to the credit score VIP lounge!”

Here are some foolproof ways to keep that ratio in check:

- Keep Balances Low: Try to use less than 30% of your available credit limit. If your credit card limit is $1,000, keep your balance under $300. It’s like keeping your ice cream cone from tipping over!

- Request Higher Credit Limits: If you’ve been a good little borrower, contact your credit card issuer to request a limit increase. Just remember, with great power comes great responsibility—don’t go on a shopping spree!

- Spread Out Your Charges: Instead of maxing out one card, use multiple cards for your purchases. It’s like sharing the weight at the gym; everyone benefits!

Related Financial Concepts

In the world of finance, credit scores are the VIP tickets that grant you access to better loans, lower interest rates, and the ability to finance that dream car you’ve been eyeing. But hold your horses! Before you dash to the dealership, let’s take a delightful jaunt through some related financial concepts that weave a colorful tapestry around your credit score.

Relationship Between Credit Scores and Loans

Credit scores are like the mystical orbs that lenders peer into when deciding whether to grant you a loan. A high credit score can make lenders swoon like a love-struck teenager, while a low score might have them running for the hills like they’ve just seen a ghost. Generally speaking, a score of 700 or above is the golden ticket that unlocks competitive loan terms and interest rates.

- Low Credit Scores: Borrowers with lower scores may face higher interest rates, akin to wearing a “bad credit” sandwich board at a loan convention. This can lead to paying significantly more over the life of the loan.

- High Credit Scores: Higher scores usually mean lower interest rates, which can save you thousands. Think of it as the perk of being the popular kid in school — everyone wants to hang out with you (or give you money)!

- Loan Approval: A stellar score boosts your chances of loan approval. It’s like having a golden ticket in ‘Charlie and the Chocolate Factory’ — lenders can’t resist!

Significance of Credit Counseling in Managing Credit

Credit counseling is the wise old owl in the realm of financial guidance, helping individuals navigate the sometimes murky waters of credit management. It’s not just for those drowning in debt; even the financially savvy can benefit from a little guidance.

- Personalized Plans: Credit counselors provide tailored strategies to improve financial health, turning your financial woes into “whoas” of financial triumph.

- Budgeting Assistance: They help craft budgets that keep your spending in check, allowing you to save for the things that really matter — like that vacation to Bali.

- Debt Management Plans: Many agencies offer plans to consolidate debt, negotiating with creditors on your behalf to lower interest rates or monthly payments.

Impact of Debt Consolidation on Credit Scores

Debt consolidation is the magical elixir that can mend your credit score, provided you use it wisely. By combining multiple debts into a single loan, borrowers simplify payments and potentially lower interest rates.

- Credit Utilization Ratio: Consolidating can lead to a decrease in your credit utilization ratio, which can help boost your score. Think of it as decluttering your credit closet — a tidy space often looks better!

- Payment History: Consistently making on-time payments on your new consolidation loan can have a positive impact on your score. It’s like feeding your credit score healthy snacks — it thrives on good behavior!

- Hard Inquiries: Taking out a new loan may cause a temporary dip in your score due to hard inquiries, but this is a short-term pain for long-term gain.

“A good credit score is like a good reputation; it gets you places.”

Final Review

So there you have it—your ticket to becoming the credit score champion you were born to be! Remember, improving your credit score isn’t just about numbers; it’s about unlocking doors to better loans, lower interest rates, and a life free of financial drama. So don your superhero cape, hit those actionable steps, and watch as your credit score soars higher than a kite on a breezy day!

Question Bank

What is a good credit score?

A good credit score typically falls between 700 and 749, but the higher, the better!

How long does it take to improve my credit score?

Can I improve my credit score without taking on more debt?

Absolutely! You can improve your score by making on-time payments and reducing existing debt.

Will checking my own credit score hurt it?

Nope! Checking your own credit score is a soft inquiry and won’t affect your score at all.

Is it possible to have too many credit cards?

Yes, having too many credit cards can negatively impact your score, especially if you have a high utilization rate.